Thank you for the opportunity to make a submission in relation to the draft superannuation reform package Bills and regulations released on the 7th of September. This submission will deal with two issues: indexing the LISTO so it keeps pace with increases to the Superannuation Guarantee rate and longer-term reporting on the objective of superannuation.

Treasury Laws Amendment (Fair and Sustainable Superannuation) Bill 2016

Indexing Low Income Superannuation Tax Offset to increases in Superannuation Guarantee rate

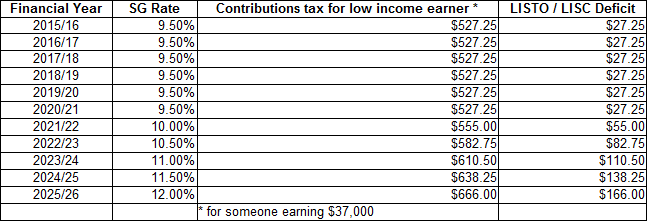

The Low Income Superannuation Tax Offset (LISTO) should be increased and indexed so that it keeps pace with increases to the Superannuation Guarantee rate.

The draft Explanatory Materials to the Bill says:

The low income superannuation tax offset seeks to effectively return the tax paid on concessional contributions by a person’s superannuation fund or retirement savings account provider to a person who is a low income earner.

However this will not be fully achieved under the LISTO as it is proposed. The LISTO is very similar to the Low Income Superannuation Contribution (LISC). When the LISC was introduced it offset the full amount of contributions tax – $500 – a low income earner would pay on their compulsory Superannuation Guarantee contributions (9% of $37,000 equals $3,330, $3,330 at 15% equals $499.50). However provision was not made to increase the LISC when the Superannuation Guarantee (SG) rate increased.

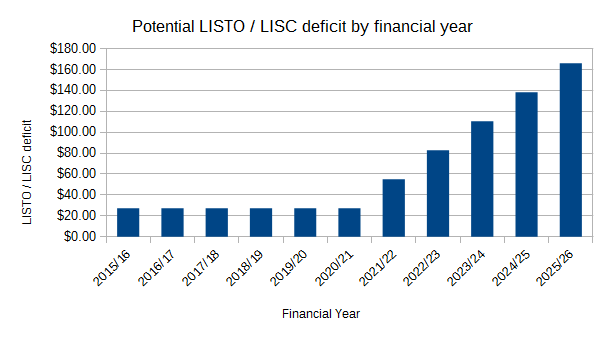

As such, as the SG rate increases, the LISC/LISTO fails to offset the full amount of contributions tax, meaning some low income earners will pay more tax on their superannuation contributions than on their salary and wages.

Table 1: Potential LISTO / LISC deficit by financial year

Figure 1: Potential LISTO deficit by financial year

I urge the Government to take the opportunity of introducing the LISTO to correct this by indexing the maximum amount of the LISTO to keep pace with increases in the SG rate and resulting contributions tax.

Superannuation (Objective) Bill 2016

Reporting on the objective of superannuation

I welcome the inclusion of a requirement for statements of compatibility in regards to the primary objective of the superannuation system in the Superannuation (Objective) Bill 2016. However I think this reporting should go further, as suggested by the Financial System Inquiry (FSI).

The FSI final report said: “In addition, Government could periodically assess the extent to which the superannuation system is meeting its objectives. This could be done in a stand-alone report or as part of the Intergenerational Report, which is prepared every five years.”

I also encourage the Government to consider regular reporting on meeting the objective of superannuation. However I think this should be done more frequently than in the Intergenerational Report, as superannuation policy changes quicker than demographic trends.